看好新能源转型!哈弗新能源核心增量!

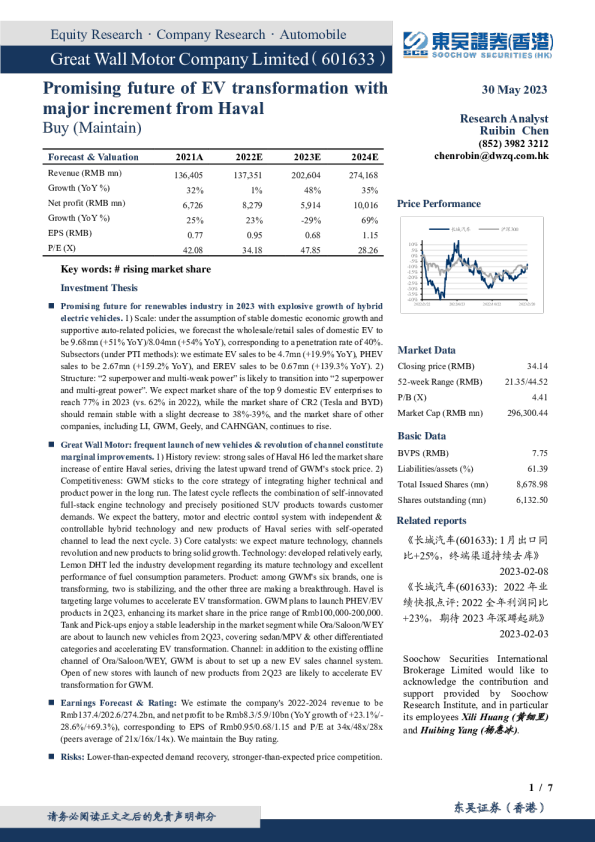

PromisingfutureofEVtransformationwithmajorincrementfromHaval Buy(Maintain) 30May2023 ResearchAnalystRuibinChen(852)39823212 chenrobin@dwzq.com.hk PricePerformance Keywords:#risingmarketshare InvestmentThesis 10% Forecast&Valuation 2021A 2022E 2023E 2024E Revenue(RMBmn) 136,405 137,351 202,604 274,168 Growth(YoY%) 32% 1% 48% 35% Netprofit(RMBmn) 6,726 8,279 5,914 10,016 Growth(YoY%) 25% 23% -29% 69% EPS(RMB) 0.77 0.95 0.68 1.15 P/E(X) 42.08 34.18 47.85 28.26 5% 0% -5% -10% -15% -20% -25% -30% -35% -40% 长城汽车沪深300 Promisingfutureforrenewablesindustryin2023withexplosivegrowthofhybrid electricvehicles.1)Scale:undertheassumptionofstabledomesticeconomicgrowthandsupportiveauto-relatedpolicies,weforecastthewholesale/retailsalesofdomesticEVtobe9.68mn(+51%YoY)/8.04mn(+54%YoY),correspondingtoapenetrationrateof40%.Subsectors(underPTImethods):weestimateEVsalestobe4.7mn(+19.9%YoY),PHEVsalestobe2.67mn(+159.2%YoY),andEREVsalestobe0.67mn(+139.3%YoY).2)Structure:“2superpowerandmulti-weakpower”islikelytotransitioninto“2superpowerandmulti-greatpower”.Weexpectmarketshareofthetop9domesticEVenterprisestoreach77%in2023(vs.62%in2022),whilethemarketshareofCR2(TeslaandBYD)shouldremainstablewithaslightdecreaseto38%-39%,andthemarketshareofothercompanies,includingLI,GWM,Geely,andCAHNGAN,continuestorise. GreatWallMotor:frequentlaunchofnewvehicles&revolutionofchannelconstitutemarginalimprovements.1)Historyreview:strongsalesofHavalH6ledthemarketshareincreaseofentireHavalseries,drivingthelatestupwardtrendofGWM'sstockprice.2)Competitiveness:GWMstickstothecorestrategyofintegratinghighertechnicalandproductpowerinthelongrun.Thelatestcyclereflectsthecombinationofself-innovatedfull-stackenginetechnologyandpreciselypositionedSUVproductstowardscustomerdemands.Weexpectthebattery,motorandelectriccontrolsystemwithindependent&controllablehybridtechnologyandnewproductsofHavalserieswithself-operatedchanneltoleadthenextcycle.3)Corecatalysts:weexpectmaturetechnology,channelsrevolutionandnewproductstobringsolidgrowth.Technology:developedrelativelyearly,LemonDHTledtheindustrydevelopmentregardingitsmaturetechnologyandexcellentperformanceoffuelconsumptionparameters.Product:amongGWM'ssixbrands,oneistransforming,twoisstabilizing,andtheotherthreearemakingabreakthrough.HavelistargetinglargevolumestoaccelerateEVtransformation.GWMplanstolaunchPHEV/EVproductsin2Q23,enhancingitsmarketshareinthepricerangeofRmb100,000-200,000.TankandPick-upsenjoyastableleadershipinthemarketsegmentwhileOra/Saloon/WEYareabouttolaunchnewvehiclesfrom2Q23,coveringsedan/MPV&otherdifferentiatedcategoriesandacceleratingEVtransformation.Channel:inadditiontotheexistingofflinechannelofOra/Saloon/WEY,GWMisabouttosetupanewEVsaleschannelsystem.Openofnewstoreswithlaunchofnewproductsfrom2Q23arelikelytoaccelerateEVtransformationforGWM. EarningsForecast&Rating:Weestimatethecompany's2022-2024revenuetobeRmb137.4/202.6/274.2bn,andnetprofittobeRmb8.3/5.9/10bn(YoYgrowthof+23.1%/-28.6%/+69.3%),correspondingtoEPSofRmb0.95/0.68/1.15andP/Eat34x/48x/28x(peersaverageof21x/16x/14x).WemaintaintheBuyrating. Risks:Lower-than-expecteddemandrecovery,stronger-than-expectedpricecompetition. 2022/2/222022/6/232022/10/222023/2/20 MarketData Closingprice(RMB) 34.14 52-weekRange(RMB) 21.35/44.52 P/B(X) 4.41 MarketCap(RMBmn) 296,300.44 BasicDataBVPS(RMB) 7.75 Liabilities/assets(%) 61.39 TotalIssuedShares(mn) 8,678.98 Sharesoutstanding(mn) 6,132.50 Relatedreports 《长城汽车(601633):1月出口同比+25%,终端渠道持续去库》 2023-02-08 《长城汽车(601633):2022年业绩快报点评:2022全年利润同比 +23%,期待2023年深蹲起跳》 2023-02-03 SoochowSecuritiesInternationalBrokerageLimitedwouldliketoacknowledgethecontributionandsupportprovidedbySoochowResearchInstitute,andinparticular itsemployeesXiliHuang(黄细里) andHuibingYang(杨惠冰). 东吴证券(香港) 1/7 看好新能源转型!哈弗新能源核心增量! 买入(维持) 2023年5月30日 分析师陈睿彬 (852)39823212 chenrobin@dwzq.com.hk 股价走势 长城汽车沪深300 盈利预测与估值 2021A 2022E 2023E 2024E 营业总收入(百万元) 136,405 137,351 202,604 274,168 同比 32% 1% 48% 35% 归属母公司净利润(百万元) 6,726 8,279 5,914 10,016 同比 25% 23% -29% 69% 每股收益-最新股本摊薄(元/股) 0.77 0.95 0.68 1.15 P/E(现价&最新股本摊薄) 42.08 34.18 47.85 28.26 关键词:#市占率上升投资要点 2023新能源行业增量可期,混动爆发为主线。1)规模维度:基于国内经济稳增长+汽车相关政策友好假设前提下,我们预测国内新能源乘用车批发销量/交强险零售分别为:968万(同比+51%)/804万(同比+54%),对应渗透率约40%。新能源分技术路线看(交强险口径,下同):EV车 型销量预计为470万(同比+19.9%),PHEV车型为267万(同比 +159.2%),增程式车型销量为67万(同比+139.3%)。2)格局维度:国内新能源车企格局趋势研判:两超多弱走向两超多强。2023年国内前9家新能源品牌市占率预计达到77%(2022年预计62%),且CR2(特斯拉+比亚迪)份额稳中微降(38%-39%),理想+长城/吉利/长安等车 企份额持续提升。 长城汽车:产品频出&渠道变革,边际催化向上。1)复盘历史:公司上一轮股价上行周期核心系SUV行业红利下,哈弗H6上市热销,带动哈弗全系车型市场份额提升,依然围绕【爆款新车】为核心。2)优势总结:坚定长期正确的事,即更强技术力与产品力的整合。上一轮长城大周期主要体现发动机技术逆向开发全栈自研+SUV产品精准定位用户需 求两大维度结合,本轮期待长城汽车三电/混动技术自主可控+哈弗新能源批量新车/独立渠道催化下开启又一轮周期。3)核心催化:技术成熟,渠道变革,新车催化有望带来强势周期。技术维度:长城柠檬DHT混动技术开发较早,技术成熟度以及产品油耗参数性能处于行业领先。产品维度:长城六大品牌一转两稳三突破,哈弗定位走量市场,加速转型新能源,Q2预计推出多款PHEV/EV新车,提升10~20万元价格带市场 份额;坦克/皮卡细分市场龙头地位稳定;魏牌/欧拉/沙龙三大品牌Q2起陆续推出全新产品,覆盖轿车/MPV等差异化类型,助力公司新能源转型。渠道维度:长城在欧拉/沙龙以及魏牌门店基础上,哈弗品牌设立 全新新能源汽车销售渠道体系,Q2开始门店陆续落地,配合新品上市 助力公司快速过渡,实现新能源转型。 盈利预测与投资评级:我们预计公司2022-2024年营业总收入1374/2026/2742亿元,归属母公司净利润83/59/100亿元,同比+23.1%/-28.6%