野村控股美股招股说明书(2025-04-15版)

AI智能总结

AI智能总结

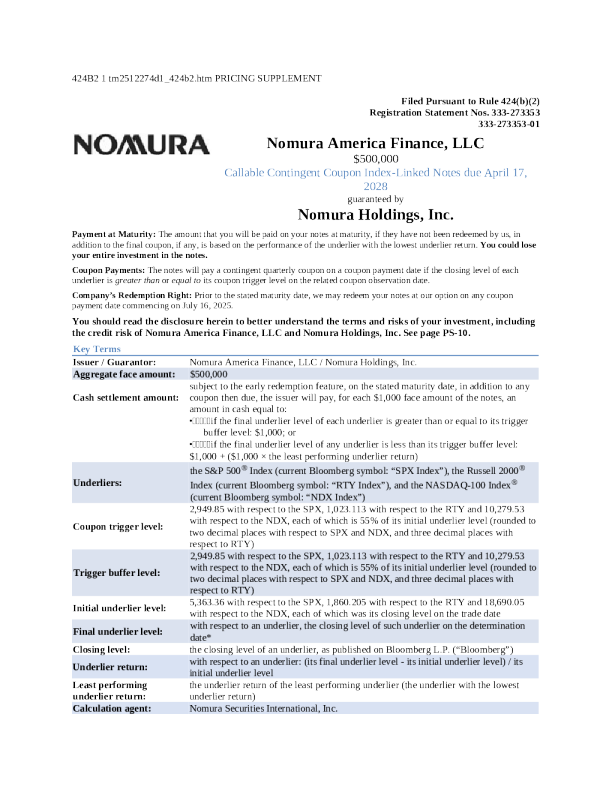

Filed Pursuant to Rule 424(b)(2)Registration Statement Nos. 333-273353333-273353-01 Nomura America Finance, LLC$500,000Callable Contingent Coupon Index-Linked Notes due April 17,2028guaranteed byNomura Holdings, Inc. Payment at Maturity:The amount that you will be paid on your notes at maturity, if they have not been redeemed by us, inaddition to the final coupon, if any, is based on the performance of the underlier with the lowest underlier return.You could loseyour entire investment in the notes. Coupon Payments:The notes will pay a contingent quarterly coupon on a coupon payment date if the closing level of eachunderlier isgreater thanorequal toits coupon trigger level on the related coupon observation date. Company’s Redemption Right:Prior to the stated maturity date, we may redeem your notes at our option on any couponpayment date commencing on July 16, 2025. You should read the disclosure herein to better understand the terms and risks of your investment, includingthe credit risk of Nomura America Finance, LLC and Nomura Holdings, Inc. See page PS-10. Key Terms * subject to adjustment as described in the accompanying product prospectus supplement Investing in the notes involves significant risks, including Nomura America Finance, LLC and NomuraHoldings, Inc.’s credit risk. You should carefully consider the risk factors under “Selected Risk Factors”beginning on page PS-9 of this pricing supplement, under “Additional Risk Factors Specific to the Notes”beginning on page PS-18 of the accompanying product prospectus supplement, under “Risk Factors” beginningon page 6 in the accompanying prospectus and any risk factors incorporated by reference into theaccompanying prospectus before you invest in the notes. The estimated value of your notes at the time the terms of your notes were set on the trade date (as determined byreference to pricing models used by Nomura Securities International, Inc.) is $ 973.70 per $1,000 face amount,which is less than the original issue price. Delivery of the notes will be made against payment therefor on the original issue date. The notes will be unsecured obligations of Nomura America Finance, LLC. Nomura America Finance, LLC is nota bank, and the notes will not constitute deposits insured by the U.S. Federal Deposit Insurance Corporation or anyother governmental agency or instrumentality. Neither the Securities and Exchange Commission nor any other regulatory body has approved ordisapproved of these securities or passed upon the accuracy or adequacy of this pricing supplement. Anyrepresentation to the contrary is a criminal offense. Goldman Sachs & Co. LLCApril 11, 2025 Key Terms (continued) Coupon:subject to the early redemption feature, on each coupon payment date, the issuer willpay, for each $1,000 of the outstanding face amount, an amount in cash equal to:•if the closing level of each underlier on the related coupon observation date isgreater than or equal to its coupon trigger level: $26.875 (2.6875% quarterly, or thepotential for up to 10.75% perannum);or•if the closing level of any underlier on the related coupon observation date is lessthan its coupon trigger level: $0Early redemption feature:The notes may be redeemed by the issuer at its option, in whole but not in part, oneach coupon payment date commencing on July 16, 2025 and ending on January 14,2028, for an amount in cash for each $1,000 of the outstanding face amount on theredemption date equal to $1,000 (along with the coupon then due).If the issuer chooses to exercise the issuer’s redemption right, it will notify the holderof this note (The Depository Trust Company) and the trustee by giving at least threebusiness days’ prior notice. We will have no independent obligation to notify youdirectly. The day the issuer gives the notice, which will be a business day, will be theredemption notice date and the immediately following coupon payment date, whichthe company will state in the redemption notice, will be the redemption date.The company will not give a redemption notice that results in a redemption date laterthan the January 14, 2028 coupon payment date. A redemption notice, once given,shall be irrevocable. PS-2 The issue price, underwriting discount and net proceeds listed above relate to the notes we sell initially. We maydecide to sell additional notes after the date of this pricing supplement, at issue prices and with underwritingdiscounts and net proceeds that differ from the amounts set forth above. The return (whether positive or negative) onyour investment in notes will depend in part on the issue price you pay for such notes. Nomura America Finance, LLC may use this prospectus in the initial sale of the notes. In addition, NomuraSecurities International, Inc. or any other affiliate of Nomura America Finance, LLC may use this prospectus in amarket-making transaction in a note after its initial sale.Unless Nomura America Finance, LLC or its agentinforms the purchaser otherwise in the c