火锅帝国

AI智能总结

AI智能总结

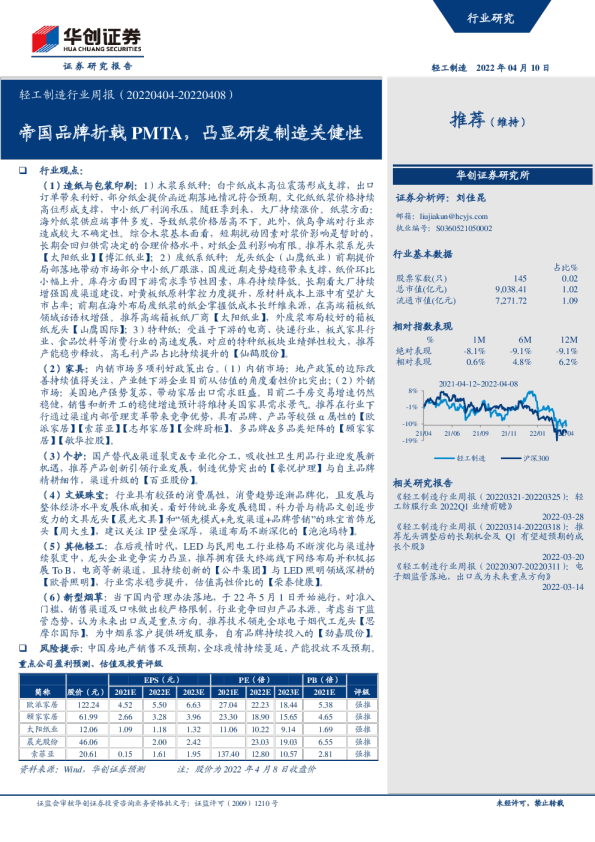

Haidilao(6862HK)|30May2023 杜韵翹 (852)39118013 anitadu@ccbintl.com 朱曉瀠 (852)39118252 anitachu@ccbintl.com ►成长中的中国火锅市场 ►同店销售增长是FY23F收入增长的主要驱动力 ►首次覆盖,给予优于大市评级,目标价19.50港元 优于大市(首次覆盖) 现价:目标价: HK$16.66▶HK$19.50 交易数据 (截至2023年5月29日)(首次覆盖) 不断增长的中国火锅市场。火锅是最具代表性的中国菜系之一。2013-2022年,中国火锅市场的复合年增长率为7.7%。根据艾媒咨询,在中国城市化进程加快和消费升级的推动下,预计中国火锅市场在FY23-25F年将继续以 6.8%的复合年增长率增长。自2022年12月疫情管控措施放宽后,火锅餐饮消费率先迎来大回暖。我们相信客流量的改善和社交聚会的回归将继续有利于今年的火锅市场。 同店销售增长是FY23F收入增长的主要驱动力。五一假期期间,海底捞到店客户数量约为530万,同比增长65%。我们相信海底捞将在短期内继续实施 适度的门店扩张计划,这意味着同店销售增长将成为其主要的收入驱动力。在28%的同店销售增长和3%的新店开张增长的支持下,我们预计海底捞 FY23F收入将同比增长37%至人民币424.2亿元。我们相信海底捞将继续实施成本管控措施以应对不断上升的工资压力。由于其强大的品牌,我们还预计海底捞FY23-25F的租金成本比率将保持稳定。我们预测FY23F员工成本比率同比下降0.3个百分点至32.7%,租金成本比率同比小幅上升0.1个百分点至1%。再加上啄木鸟计划和硬骨计划的继续实施提高了运营效率,我们预计海底捞FY23F息税前利润率将同比提高2.1个百分点至9.9%。 首次覆盖,给予目标价19.50港元。我们相信海底捞将继续受益于其强大的 品牌和稳固的供应链,以保持其市场领先地位。基于32倍2023年市盈率, 我们首次覆盖海底捞,给予目标价19.50港元。FY23-25F47%的核心收益复合年增长率、供应链中强大的议价能力和优于同行的净资产收益率支持我们高于行业的市盈率。凭借18%的上涨潜力,我们将该股评级为优于大市。 52周股价高低 11.21–24.35港元 市值百万 92,863港元/13,408美元 自由流通股数(百万股) 5,574 自由流通股份(%) 40 3个月日均成交股数(百万股) 15.5 3个月日均成交额(百万美元) 40.7 12个月预期回报率(%) 18 资料来源:彭博,建银国际证券预测股价相对于恒生国企指数 (港元)26 24 22 20 18 16 14 12 10 May-22Jun-22Jul-22Aug-22Aug-22Sep-22Oct-22Oct-22Nov-22Dec-22Dec-22Jan-23Feb-23Feb-23Mar-23Apr-23May-23 May-23 8 资料来源:彭博 海底捞恒生国企指数(rebased) 预测和估值 截至12月31日202120222023F2024F2025F 股价表现 收入(百万元人民币) 41,112 31,039 42,420 48,823 54,936 绝对表现 (12.6) (23.2) 13.5 同比(%) 43.7 (24.5) 36.7 15.1 12.5 相对于恒生国企指数表现(%) (5.9) (18.2) 27.3 净利润(百万元人民币) (4,163) 1,374 2,923 4,166 5,242 资料来源:彭博 同比(%) (1,446) N/A 113 42 26 稀释每股收益(人民币) (0.78) 0.25 0.54 0.77 0.97 同比(%) (1,443) (132) 113 42 26 市盈率(倍) N/A 58.9 28.3 19.9 15.8 每股股息(港元) – 0.12 0.18 0.26 0.33 收益率(%) – 0.7 1.1 1.5 1.9 市帐率(倍) 10.1 11.2 9.0 6.9 5.3 平均股本回报率(%) (45.9) 17.9 34.5 38.1 36.8 净负债/股本(%) 23.7 (26.0) (60.9) (80.9) (91.0) 表现区间一个月三个月十二个月 必需消费品|2023年5月30日 海底捞|6862HK 火锅帝国 资料来源:彭博,建银国际证券预测 CCBISECURITIES1 Ratingdefinitions: Outperform(O)–expectedreturn>10%overthenexttwelvemonths Neutral(N)–expectedreturnbetween-10%and10%overthenexttwelvemonthsUnderperform(U)–expectedreturn<-10%overthenexttwelvemonths Analystcertification: Theauthor(s)ofthisdocument,herebydeclarethat:(i)alloftheviewsexpressedinthisdocumentaccuratelyreflecthis/herpersonalviewsaboutanyandallofthesubjectsecuritiesorissuersandwerepreparedinanindependentmanner;(ii)nopartofanyofhis/hercompensationwas,is,orwillbedirectlyorindirectlyrelatedtothespecificrecommendationsorviewsexpressedinthisdocument;and (iii)he/shereceivesnoinsiderinformation/non-publicprice-sensitiveinformationinrelationtothesubjectsecuritiesorissuerswhichmayinfluencetherecommendationsmadebyhim.Theauthor(s)ofthisdocumentfurtherconfirmthat(i)neitherhe/shenorhis/herrespectiveassociate(s)(asdefinedintheCodeofConductforPersonsLicensedbyorRegisteredwiththeSecuritiesandFuturesCommissionissuedbytheHongKongSecuritiesandFuturesCommission)hasdealtin/tradedorwilldealin/tradethesecuritiescoveredinthisdocumentinamannercontrarytohis/heroutstandingrecommendation,orneitherhe/shenorhis/herrespectiveassociate(s)hasdealtinortradedinthesecuritiescoveredinthisdocumentwithin30calendardayspriortothedateofissueofthisdocumentorwillsodealinortradesuchsecuritieswithin3businessdaysafterthedateofissueofthisdocument;(ii)neitherhe/shenorhis/herrespectiveassociate(s)servesasanofficerofanyofthecompaniescoveredinthisdocument;and(iii)neitherhe/shenorhis/herrespectiveassociate(s)hasanyfinancialinterestsinthesecuritiescoveredinthisdocument. Disclaimers: ThisdocumentispreparedbyCCBInternationalSecuritiesLimited.CCBInternationalSecuritiesLimitedisawholly-ownedsubsidiaryofCCBInternational(Holdings)Limited(“CCBIH”)andChinaConstructionBankCorporation(“CCB”).InformationhereinhasbeenobtainedfromsourcesbelievedtobereliablebutCCBInternationalSecuritiesLimited,itsaffiliatesand/orsubsidiaries(collectively“CCBIS”)donotguarantee,representandwarrant(eitherexpressorimplied)itscompletenessoraccuracyorappropriatenessforanypurposeoranypersonwhatsoever.Opinionsandestimatesconstituteourjudgmentasofthedateofthisdocumentandaresubjecttochangewithoutnotice.CCBISseekstoupdateitsresearchasappropriate,butvariousregulationsmaypreventitfromdoingso.Besidescertainindustryreportspublishedonaperiodicbasis,thelargemajorityofreportsarepublishedatirregularintervalsasappropriateaccordingtotheanalyst'sjudgment.Forecasts,projectionsandvaluationsareinherentlyspeculativeinnatureandmaybebasedonanumberofcontingencies.Readersshouldnotregardtheinclusionofanyforecasts,projectionsandvaluationsinthisdocumentasarepresentationorwarrantybyoronbehalfofCCBISthattheseforecasts,projectionsorvaluationsortheirunderlyingassumptionswillbeachieved.Investmentinvolvesriskandpastperformanceisnotindicativeoffutureresults.Informationinthisdocumentisnotintendedtoconstituteorbeconstruedaslegal,financial,accounting,business,investment,taxoranyprofessionaladviceforanyprospectiveinvestorsandshouldnotberelieduponinthatregard.Thisdocumentisforinformationalpurposesonlyandshouldnotbetreatedasanofferorsolicitation