China Economy – Paving the way for a gradual resumption in 2023

AI智能总结

AI智能总结

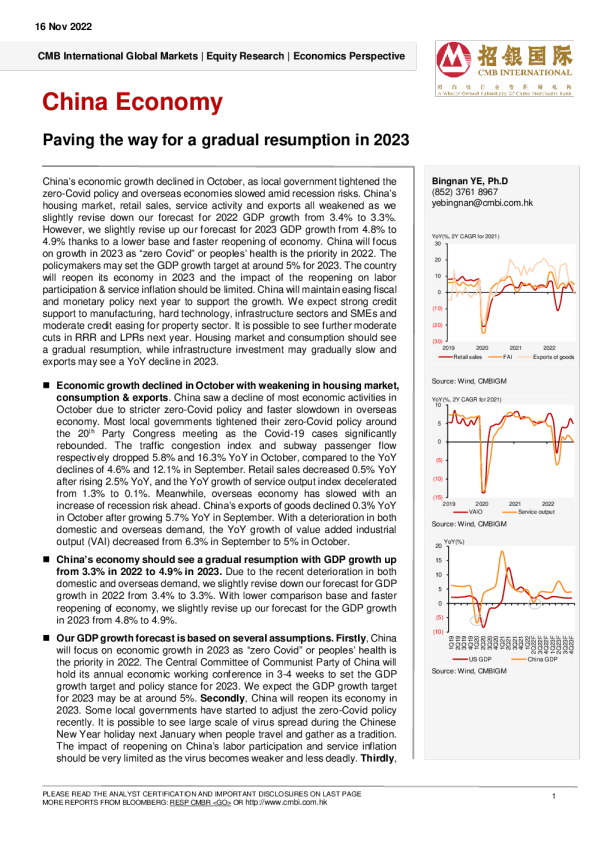

16Nov2022 CMBInternationalGlobalMarkets|EquityResearch|EconomicsPerspective ChinaEconomy Pavingthewayforagradualresumptionin2023 YoY(%,2YCAGRfor2021) 30 20 10 0 (10) (20) (30) 2019202020212022 RetailsalesFAIExportsofgoods Source:Wind,CMBIGM YoY(%,2YCAGRfor2021)10 5 0 (5) (10) (15) 2019 2020 VAIO 2021 2022 Serviceoutput Source:Wind,CMBIGM 15 10 5 0 (5) (10) USGDP Source:Wind,CMBIGM ChinaGDP BingnanYE,Ph.D (852)37618967 yebingnan@cmbi.com.hk 20YoY(%) China’seconomicgrowthdeclinedinOctober,aslocalgovernmenttightenedthezero-Covidpolicyandoverseaseconomiesslowedamidrecessionrisks.China’shousingmarket,retailsales,serviceactivityandexportsallweakenedasweslightlyrevisedownourforecastfor2022GDPgrowthfrom3.4%to3.3%.However,weslightlyreviseupourforecastfor2023GDPgrowthfrom4.8%to4.9%thankstoalowerbaseandfasterreopeningofeconomy.Chinawillfocusongrowthin2023as“zeroCovid”orpeoples’healthisthepriorityin2022.ThepolicymakersmaysettheGDPgrowthtargetataround5%for2023.Thecountrywillreopenitseconomyin2023andtheimpactofthereopeningonlaborparticipation&serviceinflationshouldbelimited.Chinawillmaintaineasingfiscalandmonetarypolicynextyeartosupportthegrowth.Weexpectstrongcreditsupporttomanufacturing,hardtechnology,infrastructuresectorsandSMEsandmoderatecrediteasingforpropertysector.ItispossibletoseefurthermoderatecutsinRRRandLPRsnextyear.Housingmarketandconsumptionshouldseeagradualresumption,whileinfrastructureinvestmentmaygraduallyslowandexportsmayseeaYoYdeclinein2023. EconomicgrowthdeclinedinOctoberwithweakeninginhousingmarket,consumption&exports.ChinasawadeclineofmosteconomicactivitiesinOctoberduetostricterzero-Covidpolicyandfasterslowdowninoverseaseconomy.Mostlocalgovernmentstightenedtheirzero-Covidpolicyaroundthe20thPartyCongressmeetingastheCovid-19casessignificantlyrebounded.Thetrafficcongestionindexandsubwaypassengerflowrespectivelydropped5.8%and16.3%YoYinOctober,comparedtotheYoYdeclinesof4.6%and12.1%inSeptember.Retailsalesdecreased0.5%YoYafterrising2.5%YoY,andtheYoYgrowthofserviceoutputindexdeceleratedfrom1.3%to0.1%.Meanwhile,overseaseconomyhasslowedwithanincreaseofrecessionriskahead.China’sexportsofgoodsdeclined0.3%YoYinOctoberaftergrowing5.7%YoYinSeptember.Withadeteriorationinbothdomesticandoverseasdemand,theYoYgrowthofvalueaddedindustrialoutput(VAI)decreasedfrom6.3%inSeptemberto5%inOctober. China’seconomyshouldseeagradualresumptionwithGDPgrowthupfrom3.3%in2022to4.9%in2023.Duetotherecentdeteriorationinbothdomesticandoverseasdemand,weslightlyrevisedownourforecastforGDPgrowthin2022from3.4%to3.3%.Withlowercomparisonbaseandfasterreopeningofeconomy,weslightlyreviseupourforecastfortheGDPgrowthin2023from4.8%to4.9%. 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22F 3Q22F 4Q22F 1Q23F 2Q23F 3Q23F 4Q23F OurGDPgrowthforecastisbasedonseveralassumptions.Firstly,Chinawillfocusoneconomicgrowthin2023as“zeroCovid”orpeoples’healthisthepriorityin2022.TheCentralCommitteeofCommunistPartyofChinawillholditsannualeconomicworkingconferencein3-4weekstosettheGDPgrowthtargetandpolicystancefor2023.WeexpecttheGDPgrowthtargetfor2023maybeataround5%.Secondly,Chinawillreopenitseconomyin2023.Somelocalgovernmentshavestartedtoadjustthezero-Covidpolicyrecently.ItispossibletoseelargescaleofvirusspreadduringtheChineseNewYearholidaynextJanuarywhenpeopletravelandgatherasatradition.TheimpactofreopeningonChina’slaborparticipationandserviceinflationshouldbeverylimitedasthevirusbecomesweakerandlessdeadly.Thirdly, PLEASEREADTHEANALYSTCERTIFICATIONANDIMPORTANTDISCLOSURESONLASTPAGE1 MOREREPORTSFROMBLOOMBERG:RESPCMBR<GO>ORhttp://www.cmbi.com.hk Chinawillmaintainproactivefiscalpolicywithhigherbroaddeficitandprudentmonetarypolicywitheasingbiasin2023.BroaddeficitincludinggeneralfiscaldeficitandlocalgovernmentspecialbondquotamayincreasebyRMB600-800bnwithbroaddeficittoGDPratioslightlyupfrom5.8%in2022to5.9%-6%in2023.ThePBOCwouldmaintainampleliquidityconditionwithpossiblefurtherRRRcutnextyear.Weexpectstrongcrediteasingformanufacturing,hardtechnology,infrastructuresectorsandSMEs.LPRsmayseefurthermoderatedeclinesin2023.BanksareencouragedtorollovermatureddebtsofpropertydevelopersandLGFVs.Fourthly,Chinawillfurthermoderatelyeasecreditpolicytowardspropertysectorasdown-paymentratioandmortgageratesfor1stand2ndhomebuyersmayhaveadditionalmoderatedownsideroomnextyear.Lastly,theUSislikelytoseeamoderaterecessionasweexpectChina’sexportsofgoodstodropby4%in2023afterrising8%in2022. Housingmarket&durableconsumptionweakenedinOctoberandmaygraduallyresumeinfuture.Duetostricterzero-Covidpolicy,grossfloorarea(GFA)soldforcommoditybuildingsandpropertydevelopmentinvestmentrespectivelydropped23.2%and16%YoYinOctoberafterdecreasing16.4%and12.1%YoYinSeptember.DurableconsumptionalsodeterioratedastheconfidenceremainedweakandconsumerspostponedshoppingfortheSingle’sDay.Retailsalesofhomeappliance,furnitureandconstruction&decorationmaterialsrespectivelydropped14.1%,6.6%and8.7%YoYinOctoberafterdeclining6.1%,7.3%and8.1%YoYinSeptember.Meanwhile,retailsalesofcommunicationequipmentandcult